In today’s data-driven world, credit scores have become a central pillar of personal finance. Whether you’re applying for a mortgage, financing a car, or using a digital lending platform, that three-digit number often determines your access to credit. Once used primarily by banks, credit scores now influence a wide range of financial decisions, impacting individuals far beyond traditional lending. As these scores grow in importance, it’s crucial to understand what they represent and how they fit into the broader financial ecosystem. For anyone navigating modern lending, a clear grasp of credit scoring is no longer optional—it’s essential.

What a Credit Score Actually Represents

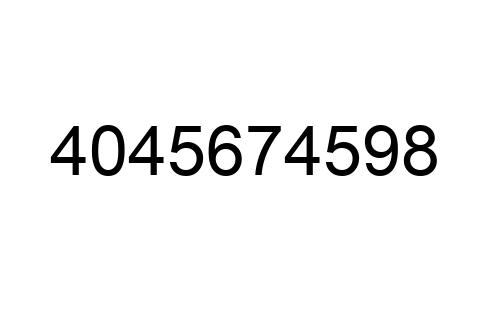

At its core, a credit score reflects a person’s creditworthiness. It condenses years of borrowing behavior into a single metric that lenders use to assess risk. The most common model, FICO, ranges from 300 to 850. A higher score suggests responsible credit usage, while lower scores may reflect late payments, high balances, or defaults. But it’s not just about good or bad behavior—it’s about patterns over time.

A single late payment won’t tank a score, but recurring missed payments likely will. Credit utilization, payment history, length of credit, and types of credit all factor into this evolving snapshot.

Why Lenders Rely on Scores

For financial institutions, lending comes down to risk management. Credit scores help standardize that process. Rather than relying solely on subjective evaluations or lengthy manual reviews, banks and lenders can make quicker decisions based on a reliable indicator. A borrower with a 770 credit score, for example, is statistically less likely to default than someone in the low 600s. That level of precision allows for tiered interest rates, where higher scores unlock better terms. It also helps reduce underwriting costs for lenders, which in turn affects availability and affordability for borrowers.

The Shift to Digital Lending Platforms

Even with the rise of fintech companies and app-based lending, credit scores are still important. Traditional banks often required in-person verification and longer approval timelines. Now, platforms can pre-qualify users instantly, often based on automated score checks.

While many digital lenders incorporate alternative data—such as utility payments or rental history—most still treat the credit score as the first filter. In this context, a good score doesn’t just increase your odds of approval. It can also accelerate access, lower fees, and offer more favorable repayment terms.

Beyond Loans: Where Credit Scores Show Up

Credit scores influence more than just loans. Landlords routinely pull scores during tenant screenings. Employers in certain sectors may request credit checks for new hires. Insurance companies use scores to help price auto and home policies.

Even utility providers or cellphone companies may check credit before setting up an account. In each of these cases, the score serves as a proxy for responsibility and trustworthiness. It’s not a perfect system, but it’s deeply embedded in how businesses assess individual risk.

The Weight of a Few Numbers

What makes credit scores so powerful is also what makes them problematic. A minor mistake—like a missed payment or an error on a credit report—can have outsized consequences. Worse, these scores can be slow to revitalize, even after corrective action is taken.

Consumers with limited credit history, often younger individuals or those in marginalized communities, may also be unfairly penalized by a lack of data. This creates a feedback loop: low scores limit access, which in turn restricts opportunities to improve the score.

A Tool, Not a Verdict

While credit scores carry influence, they are just one part of the broader credit assessment process. Some lenders may consider income stability, employment history, or banking relationships. Others might use proprietary algorithms that blend credit scores with behavioral data.

Still, it remains important to treat the score seriously. Monitoring it regularly, disputing inaccuracies, and practicing responsible credit habits can make a measurable difference over time. In the digital age, that kind of proactive approach isn’t optional—it’s essential.

How Credit Scores Shape Economic Opportunity

At a macro level, widespread access to credit fuels consumer spending, homeownership, and entrepreneurship. But that access is not equally distributed. In underserved areas, low average scores may correlate with fewer lending options, higher borrowing costs, and reduced economic mobility. As a result, national conversations around financial inclusion often return to credit access and scoring fairness.

Efforts by regulators and fintech startups aim to address these disparities, but the gap remains significant. Any discussion of credit scores must also acknowledge their impact on systemic equity and financial resilience.

The Road Ahead: Evolving Models and Alternatives

As consumer expectations evolve, so too does the credit ecosystem. New scoring models like FICO 10T and VantageScore 4.0 attempt to offer more nuanced assessments by incorporating trends and broader data sets. These models aim to better reflect how people manage debt in real life—especially those with thin credit history or recent fluctuations.

Meanwhile, some startups are experimenting with AI-driven risk assessments, bypassing traditional scores altogether. While these innovations promise more personalized and inclusive evaluations, they also raise new questions about data privacy and fairness.

Why Awareness Matters

For consumers, understanding how credit scores work—and how they’re used—has never been more important. Inaccurate assumptions can lead to costly mistakes, whether it’s applying for a loan too soon, ignoring errors on a report, or closing accounts that help establish credit age. Education around credit literacy is growing, but gaps persist.

People who take the time to understand their credit profile are better positioned to make informed financial choices. That knowledge translates into savings, security, and access to opportunities that might otherwise be out of reach.

Your Score Isn’t Fixed—It’s a Signal

In today’s financial world, a credit score is less a label and more a signal—one that evolves with your financial behavior. It’s not the full story of who you are, but it does influence how the financial world treats you. As digital systems become more intertwined with everyday decisions, credit scores are likely to grow even more influential. That makes it all the more vital to treat your score as an asset worth managing with care.